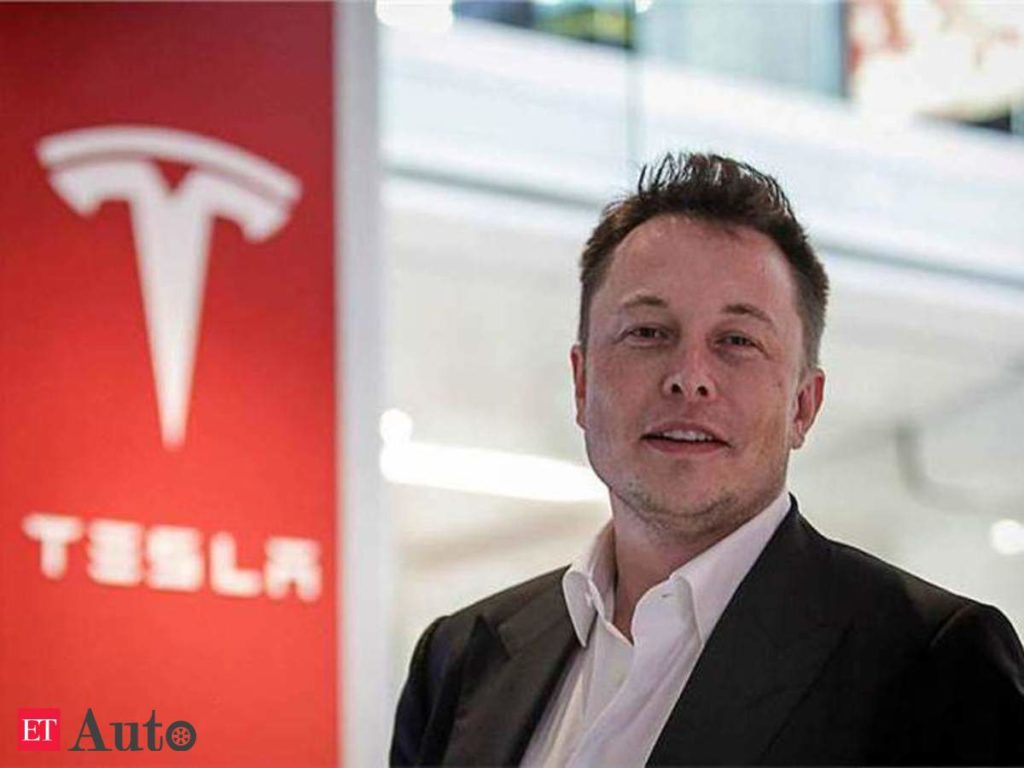

Elon Musk may lose his job as Tesla CEO as the car makers Board as well as the US Securities and Exchange Commission (SEC) must have taken into account his bizarre tweet that left Teslas market value go down by $14 billion in hours.

The tweet saying that Tesla stock was “too high” also knocked $3 billion off Musk’s own stake in the electric car-maker.

His earlier notorious tweet in August 2018 when he posted about Tesla “going private, funding secured” at $420 a share cost him his role as Chairman.

The August 2018 tweet resulted in Musk and Tesla reaching a settlement of fraud charges with the SEC. The settlement included $40 million in penalties, split equally between the company and Musk, and the removal of Musk as chairman of the Tesla board.

“As a result of the settlement, Elon Musk will no longer be Chairman of Tesla, Tesla’s board will adopt important reforms — including an obligation to oversee Musk’s communications with investors — and both will pay financial penalties,” Steven Peikin, Co-Director of the SEC’s Enforcement Division, said in a statement.

According to the SEC’s complaint, Musk’s misleading tweets caused Tesla’s stock price to jump by over six percent on August 7, and led to significant market disruption.

On Friday, Musk again stirred the controversy by tweeting that “Tesla stock price is too high imo (in my opinion)”.

Tesla’s market valuation was worth around $141 billion before the first tweet and it nosedived to nearly $127 billion.

One user replied to Musk: “Are you doing it because you need the cash or is this to protest the world burning down?”

Musk replied: “Don’t need the cash. Devoting myself to Mars and Earth. Possession just weigh you down”.

Musk is supposed to seek pre-approval if his tweets include anything regarding the company’s securities, including his acquisition or disposition of shares, nonpublic legal or regulatory findings or decisions.